Thousands of Nigerians are reeling from the sudden collapse of CBEX, a digital trading platform that promised high returns. The platform, once popular for its bold promise of 100% returns in 30 days, has now gone silent. For many users, it feels like the ground has disappeared beneath their feet.

Reports suggest that over ₦1.3 trillion may have vanished from investors’ wallets. Users woke up to find their account balances wiped clean. The platform blocked its Telegram channels, and instead of processing withdrawals, it offered new “verification” deals—pay $100 to access $1,000, or $200 for $2,000.

What Really Happened?

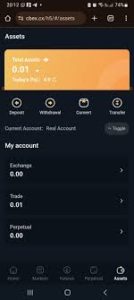

Taiwo Owolabi, a crypto and security analyst, broke it down during a discussion on X (formerly Twitter). According to him, CBEX was never a licensed platform. Its design mimicked legitimate exchanges like ByBit, but the site had major red flags. Behind the scenes, payments were directed into a TRX wallet. The money was quickly converted into USDT and ETH.

Users never saw real funds. Their dashboards showed growing balances, but these were just numbers. The so-called AI trading was fake. In reality, withdrawals relied on new deposits from other users—a classic “rob Peter to pay Paul” model. Owolabi says the whole setup was a textbook Ponzi scheme.

Voices from the Ground

The crash left a trail of emotional and financial devastation. On social media, videos surfaced of women crying after losing life savings. One user, @edoPeekeen, captured the national mood: “Even people who didn’t invest are crying. You can’t tell what’s real anymore.”

Others blamed victims for ignoring obvious signs. “Nigerians don’t learn,” said @ricky_chiekezie. “Another platform will come up and people will still rush in.” Some, like @DSegaj, pointed out the lack of financial education. “If wealth management were easy, financial advisors wouldn’t exist.”

Regulatory Action Kicks In

In response to CBEX’s collapse, the Securities and Exchange Commission (SEC) issued a public warning. Backed by the new Investments and Securities Act, 2025 (ISA 2025), the SEC now has clear authority to regulate digital platforms.

“It is now illegal in Nigeria to run digital or forex trading services without registering with the SEC,” the commission said in a statement. Violators face serious consequences, including jail time and fines starting from ₦20 million.

Dr. Emomotimi Agama, SEC’s Director General, called the law “a landmark step” that brings Nigeria’s capital markets in line with global standards. “Innovation is welcome,” he said, “but it must happen within a regulated space that protects investors.”

Why CBEX Was Dangerous

CBEX’s promises were too good to be true. It claimed to offer safe and high-yield investments, but multiple signs pointed to fraud. Users reported flashy but fake withdrawal records. These were meant to create an illusion of activity. In truth, the platform was locking funds and misleading investors.

Worse still, CBEX reportedly made false claims about being licensed in Canada and Japan. These tricks were used to gain trust and lure in more unsuspecting users.

SFC Raises Red Flags

Adding to the growing concern, the Hong Kong Securities and Futures Commission (SFC) also issued an alert. It warned that CBEX and a related platform, Bitget Pro, might be involved in virtual asset fraud. The Hong Kong Police even blocked websites linked to these entities.

The SFC noted that the withdrawal process was unclear and full of obstacles. Fake transaction records were used to hide the real financial status of user accounts.

The Bigger Picture

CBEX is not the first platform to crash in Nigeria. From MMM to MBA Forex, Nigerians have seen this cycle before. A shiny new investment promise arrives, people rush in, and soon, the whole scheme falls apart.

The Central Bank of Nigeria has consistently warned against such platforms. Despite this, many continue to risk their money without checking for licenses or regulatory approval.

Lessons to Learn

Financial experts advise investors to do their homework. Before investing, confirm that the platform is registered with the SEC. Avoid platforms that promise huge profits with little explanation.

Also, don’t invest money you cannot afford to lose. Digital investment may be the future, but it must be done wisely. Regulation, transparency, and financial education are key to avoiding future heartbreaks.

In Summary

The collapse of CBEX has been a painful reminder of the risks of unregulated investments. The new SEC law is a welcome move. It aims to protect investors and hold fraudsters accountable.

For now, those affected by CBEX must wait for possible legal action. And for everyone else, this is a wake-up call: always choose verified, transparent, and regulated investment platforms.

For more news: www.decode.ng